Some Known Incorrect Statements About Pvm Accounting

Some Known Incorrect Statements About Pvm Accounting

Blog Article

Pvm Accounting for Dummies

Table of ContentsWhat Does Pvm Accounting Mean?The Of Pvm AccountingThings about Pvm AccountingPvm Accounting for DummiesPvm Accounting Fundamentals ExplainedSome Known Details About Pvm Accounting

Look after and deal with the creation and approval of all project-related invoicings to consumers to cultivate good interaction and avoid problems. construction taxes. Make certain that proper records and paperwork are sent to and are updated with the internal revenue service. Make certain that the accounting process conforms with the legislation. Apply needed building and construction accounting requirements and treatments to the recording and reporting of construction activity.Connect with numerous funding firms (i.e. Title Business, Escrow Firm) concerning the pay application process and needs needed for repayment. Aid with carrying out and maintaining internal monetary controls and treatments.

The above declarations are meant to explain the basic nature and degree of work being done by individuals designated to this category. They are not to be construed as an exhaustive listing of duties, duties, and skills required. Personnel may be needed to execute duties beyond their regular duties once in a while, as required.

Examine This Report on Pvm Accounting

You will help sustain the Accel team to guarantee distribution of successful on time, on budget plan, projects. Accel is looking for a Building Accountant for the Chicago Office. The Building and construction Accountant executes a variety of bookkeeping, insurance coverage conformity, and task administration. Functions both independently and within details departments to preserve economic documents and ensure that all documents are maintained existing.

Principal responsibilities include, but are not limited to, dealing with all accounting features of the business in a prompt and precise manner and offering reports and routines to the company's CPA Company in the prep work of all economic declarations. Makes certain that all audit treatments and features are managed precisely. Accountable for all monetary records, pay-roll, financial and day-to-day operation of the accountancy function.

Prepares bi-weekly trial balance records. Works with Project Managers to prepare and upload all regular monthly billings. Processes and issues all accounts payable and subcontractor settlements. Produces monthly recaps for Employees Payment and General Liability insurance policy premiums. Creates monthly Work Cost to Date records and working with PMs to integrate with Project Supervisors' allocate each task.

The 5-Second Trick For Pvm Accounting

Effectiveness in Sage 300 Building And Construction and Genuine Estate (formerly Sage Timberline Workplace) and Procore building administration software an and also. https://www.kickstarter.com/profile/pvmaccount1ng/about. Need to additionally excel in various other computer system software program systems for the prep work of reports, spreadsheets and various other audit evaluation that may be required by management. Clean-up bookkeeping. Should possess solid business skills and capacity to focus on

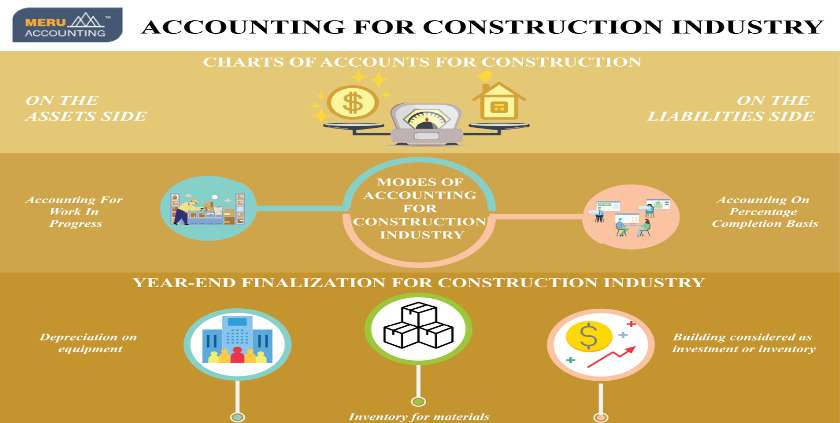

They are the financial custodians who make certain that building and construction jobs stay on budget plan, adhere to tax obligation guidelines, and maintain economic transparency. Building and construction accountants are not simply number crunchers; they are calculated companions in the building procedure. Their main duty is to take care of the financial elements of construction tasks, guaranteeing that sources are assigned successfully and financial dangers are minimized.

Pvm Accounting - Questions

They work carefully with job supervisors to produce and check budget plans, track expenses, and projection financial needs. By maintaining a limited grasp on task funds, accountants help prevent overspending and financial setbacks. Budgeting is a keystone of effective building projects, and building and construction accounting professionals contribute in this regard. They develop in-depth you can try these out budgets that incorporate all task expenditures, from products and labor to authorizations and insurance.

Building and construction accounting professionals are fluent in these laws and make certain that the task conforms with all tax requirements. To excel in the duty of a building and construction accounting professional, individuals need a strong instructional foundation in bookkeeping and financing.

Additionally, accreditations such as Qualified Public Accountant (CPA) or Licensed Building Market Financial Specialist (CCIFP) are very regarded in the industry. Building jobs commonly entail limited due dates, transforming guidelines, and unanticipated expenditures.

The Ultimate Guide To Pvm Accounting

Ans: Construction accounting professionals produce and keep track of spending plans, determining cost-saving opportunities and making certain that the project remains within budget. Ans: Yes, building accountants handle tax compliance for building projects.

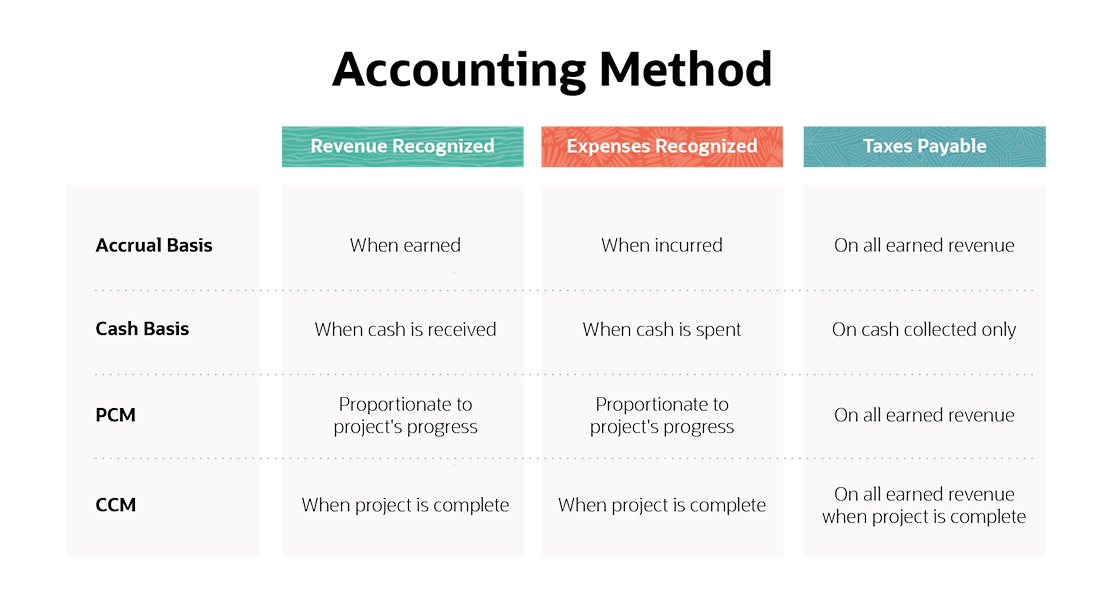

Intro to Building And Construction Accountancy By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction business need to make difficult options amongst many monetary options, like bidding process on one task over another, choosing funding for products or tools, or setting a job's revenue margin. In addition to that, building and construction is a notoriously unstable market with a high failure rate, slow-moving time to payment, and inconsistent capital.

Production involves repeated processes with conveniently recognizable prices. Production calls for various procedures, products, and tools with differing expenses. Each job takes place in a new area with differing website conditions and distinct challenges.

Not known Facts About Pvm Accounting

Regular usage of various specialized service providers and suppliers affects efficiency and cash flow. Payment arrives in full or with regular payments for the complete agreement amount. Some portion of payment may be withheld till task conclusion even when the professional's work is finished.

Normal manufacturing and temporary contracts lead to manageable capital cycles. Irregular. Retainage, slow settlements, and high ahead of time expenses bring about long, irregular cash money circulation cycles - construction accounting. While traditional suppliers have the advantage of controlled settings and optimized manufacturing processes, construction business must constantly adapt to every new job. Also somewhat repeatable projects need alterations because of website conditions and other variables.

Report this page